It has now been 2 weeks since the RBA announcement and most lenders have responded by announcing changes to their standard variable rates. ANZ and ING DIRECT were quick out of the blocks passing the full RBA cut on to their customers. Then in stepped the CBA - the market leader kept 5 points of the rate cut for itself announcing that it was for their clients with deposits (no mention of shareholders?). Other lenders found this margin grab impossible to resist! Nearly every announcement from then, was for a 20 point cut, the notable exception being Westpac which moved down by 22 points.

Has the property market been boosted by lower interest rates?

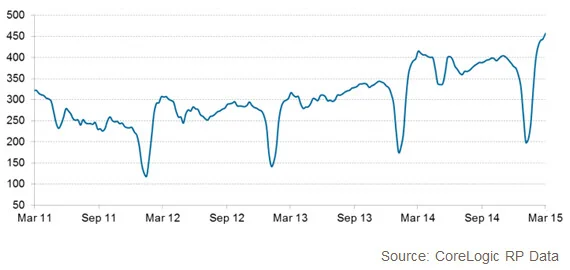

/According to RP Data there are early signs that lower interest rate are providing further stimulus to the property market. They are basing this conclusion on auction clearance rates during February being at their highest level for 6 years. In Sydney the clearance rate has averaged over 80% for the past 4 weeks.

The number of auctions being held has also increased by 9% over the corresponding period last year. While this cannot be attributed to the recent rate cut it does demonstrate that the long term lower interest rate environment is having an effect.

RP Data also reports that one of its leading market indicators, real estate agent activity, is also on the rise. Agents are requesting a higher than normal volume of Comparative Market Analysis reports. This should lead to an increase in the number of properties being advertised for sale in coming weeks.

RP Data Listings Index - March 2011 to March 2015

For more information you can read the full article here.

Looking to invest in property? Some words of caution.

/Supply / Demand Forces Also Apply in the Property Market

Tim Lawless from Core Logic RP Data has written an excellent article showing how the long awaited property development boom may lead to a potential oversupply of certain types of dwelling in some markets. For example he notes that 41% of the building approvals in the inner Sydney region are concentrated in the Waterloo-Beaconsfield area. Most of these will be multi-unit developments.

You can read Tim's full article here:

The ABC's economic commentator, Michael Janda also notes that, in spite of the prevailing myth, property prices do not always rise.

The above house in Port Hedland, WA was purchased for $1.3M in 2011. (Photo: Jan Ford Real Estate)

During the weekend it passed in at auction with a highest bid of $360,000. One can only hope that the original investor has not been stranded with finance at 80% of their purchase price of $1.3M. Be very careful about investing in one industry or boom towns. The cycle can turn severely in both directions.

Housing Market Update

/RP Data has just issued its latest property market update. Average price growth in Sydney in the year to September is 14.3% with the market at new peak levels. Median dwelling price is $655,000.

For more details you can view the summary from Tim Lawless here.

Photo competition winner announced

/Loanscape are pleased to declare the winner of our My Community photo competition.

Read MoreDo not rely on your super for trauma cover

/It’s a common misconception that can leave your clients unprotected. If you think you are covered in your super, check your cover carefully because it’s often life cover and NOT trauma. This means that you will not receive any cover if you are unable to work due to serious illness or injury - a time when you will probably need it most.

Before 1 July 2014

Critical illness cover could be provided via superannuation (providing your fund allowed it). However, if you made a claim the proceeds were paid directly into your superannuation fund. In order to access them you needed to meet stringent conditions of release in line with the rules governing the superannuation industry. Generally superannuation proceeds are only available at retirement, death, total and permanent disability or terminal illness. This meant that there was a huge risk that you could be eligible for a claim, but unable to get the claim proceeds physically out of your superannuation fund when you needed them the most.

As of 1 July 2014

No new critical illness insurance via superannuation can be offered by super funds. This is because there is no condition of release consistent with critical illness which would release the insurance benefits if there is a successful claim on the insurance contract.

The statistics speak volumes:

Loanscape has today released its Borrowing Capacity Index for Q4/2024. It confirms the forecast trend that borrowing capacities of Australian individuals and families are recovering from their low levels which coincided with the last of the recent increases to borrowing rates initiated by the Reserve Bank of Australia.