Scalpel or Machete - Has APRA Cut Too Hard?

/There has been much scrutiny given to the ALP's proposal to modestly wind back negative concessions to future property investors. Put simply, Labor wishes to restrict these benefits to those who invest in new housing stock, presumably as this type of investment assists in the increase of housing supply, thereby taking pressure off housing prices. Modelling by Federal Treasury showed that the policy is likely to lead to only a modest reduction in house prices.

The Federal Government has consistently opposed changes to negative gearing concessions, arguing that they will lead to a calamitous collapse in prices in the property market and that it would "crash confidence in the economy". The argument goes that if you remove one third of prospective buyers from the property market it will lead to a crash in housing prices.

Yet that it is exactly what is occurring now.

APRA's Intervention in Bank Lending

Over the past 3 years the Australian Prudential Regulation Authority (APRA) has become increasingly prescriptive in its regulation of the credit policies of Australia's banks. Changes introduced have included:

- placing a cap on investment lending growth which resulted in the banks imposing sharp increases to interest rates for new and existing investment loans

- limiting the flow of new interest-only lending to 30% of all new loans (previously it was running at above 40%)

- introducing credit controls including the introduction of a much more conservative floor rate in loan assessments, applying stress interest rates to entire lending portfolios, and applying increased verification measures or scrutiny around existing liabilities and applicants' living expenses.

- most recently, some banks have mandated expense allowances for investment properties, effectively meaning that income assessments are now based on the assumption that rental properties have 20-25% vacancy rates.

APRA's reasons for imposing these credit controls are summarised in my article "Never So Much Interest in Interest-Only" published in September 2017.

What are the effects of these changes?

- Investment Loans are now more expensive with the major banks applying a 40 to 50 bps interest rate premium for investment loans

- Bank profits have increased as they have been allowed to increase margins on existing investment loans at the stroke of a pen.

- Many investor borrowers are now stuck in prisoner loans - where they cannot even refinance their existing debt to a lower cost lender because they can no longer qualify for the level of debt they had previously had approved.

- Many prospective property investors find they cannot obtain finance at all.

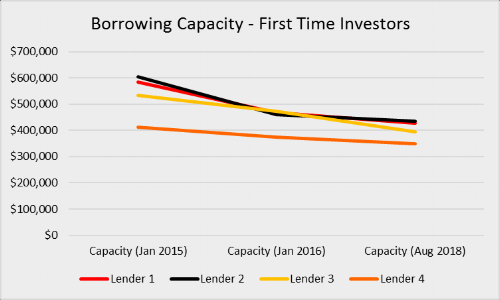

The two charts below show how credit policy changes have affected the borrowing capacity of prospective property investors over the past 3 years. In each case we have kept the borrower income and liability situation static. The only change is in bank credit policy.

Scenario 1 - "Mum and Dad" Investors

Family Situation: Couple with 2 children, modest home loan remaining, family employment income: $100,000 pa

Lenders: 3 major banks, 1 second tier bank

Scenario: seeking to purchase first investment property

CHart 1 - Copyright, LOANSCAPE 2018

Scenario 2 - "Seasoned" Multi Property Investors

Family Situation: Couple with no dependent children, no home loan, family employment income: $135,000 pa with two existing investment properties (both under finance) earning 3.5% pa gross rental return

Lenders: 3 major banks, 1 second tier bank

Scenario: seeking to purchase third investment property

Chart 2, Copyright - Loanscape 2018

“The only change is in bank credit policy”

Both charts show that access to property finance for investors has reduced dramatically. Multiple property investors have been hit the hardest. Compared with the situation in January 2015, for every $1M in debt held by a property investor, they now require $30,000 additional annual net income to qualify for the same loan.

The Assistant Treasurer has referred to controls introduced under her supervision as being "scalpel like" The above charts show something more akin to the swipes of a machete!

APRA's intent in removing the heat from the property market has been clear. But I argue that it reacted far too late: only after 3 years of rapid price growth in the Sydney and Melbourne property markets. We are now living with the consequences.

The outcome is that few people (other than the banks) are happy. High property prices mean that many first home buyers and upgraders find the stretch to property ownership too hard or too risky, those who purchased at the peak are seeing their equity ebb away, and many investors are feeling the pinch - their bank has raised interest rates by 25%, they cannot refinance, and repayments are set to increase by a further 30 to 40% when loans roll out of their interest-only phase.

The only question now is when the Sydney property market will find its new equilibrium. I suspect we are not there yet.