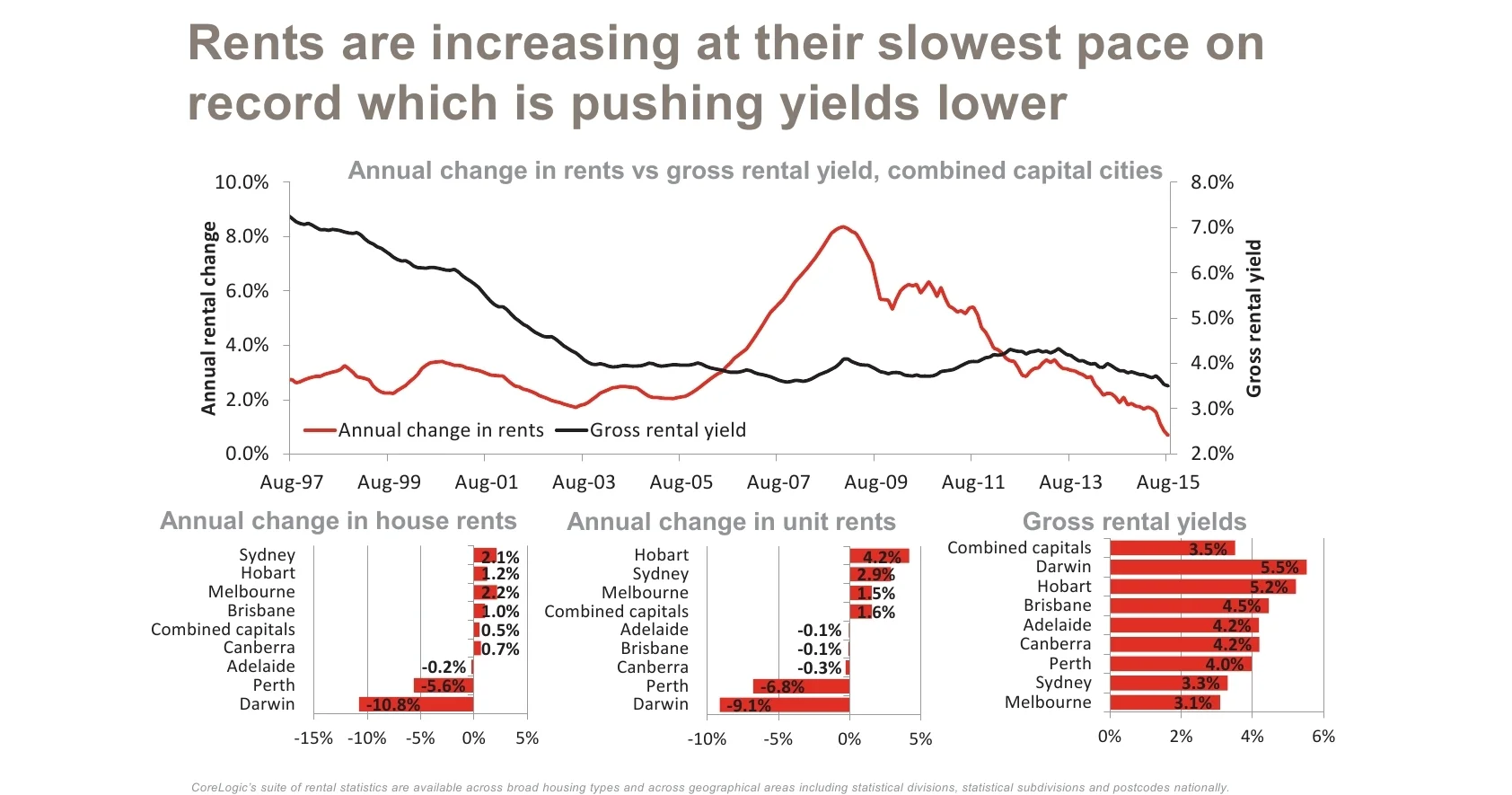

Rental Yields Continue to Fall

/Recent data released by Core Logic RP Data confirm the long term trend decline in real rental returns.

- Capital city rental values have increased by just 0.7% in the past year - the slowest year on year rate of growth ever recorded

- Property prices have increased at a faster pace meaning that real rental yields have fallen

There are several reasons for this:

- slower population growth

- the strong increase in the relative participation by investors in the property market which increases the rental stock

- concentration of new developments in areas such Sydney's inner ring and Brisbane city flooding some localities with new apartments.

So, if you are looking to invest in property then it pays to be highly selective in the areas and property types you choose. Borrowing 105% of the purchase price at say, 4.75% pa to receive a net return of 3% (after holding costs) places a very strong reliance on capital gain (speculation) for the investment to achieve an acceptable wealth outcome for the risks involved.

In the past property investment has provided lucrative returns for many investors. Past real estate price booms have been driven by demographic changes, social changes, foreign investment and recent drops in interest rates. It is difficult to see where the new growth will come from.

Can interest rates drop significantly lower? Perhaps. Will there be another social change that means that we move, say from 2 incomes to 3 to service borrowings? Unlikely. The foreign investment boom has already waned and is unlikely to resume in the short term.

The lesson is that if you think property investment is a good idea do not expect that what happened in the past will necessarily be repeated in the future. In my view successful investors will be those who:

- have a strong concept of why a particular investment will achieve its target returns

- good financial modelling to calculate real after tax returns over various market scenarios

- sound risk management

- stable cash flow to facilitate managing the investment over a period of 10 years or more.