How do the new lending restrictions affect you?

With the weakening of the economy due to the pandemic, the RBA has enforced consistently low interest rates. As a result, Australians are now borrowing more to buy, fuelling demand. Coupled with a lack of supply, this has led to property property prices skyrocketing over the past 12 months. Prices are likely to remain high exacerbating the issue of housing affordability, particularly for first home buyers.

Economic conditions remain dire (with a $134 billion deficit for the previous year) and the rising housing debt to income ratio only causes more concern for the stability of Australia’s economy, in particular the banking sector. This has spurred financial regulators into action, as measures previously discussed have now been implemented.

What measures were put in place?

Every lender is required to have an assessment rate - which is higher than the actual rate charged on the home loan - that it uses when assessing whether a home loan should be approved. This higher rate acts as a buffer to minimise the risk of the individual defaulting on the loan due to interest rates increasing in the future.

The assessment rate was previously required to be 2.5% higher than the actual variable interest rate charged. APRA mandated this to be raised by 0.5% so that the minimum assessment rate is 3% higher than the lender’s interest rate, for all new loan applications starting 1st November.

How does this affect you?

The 0.5% increase reduces the borrowing capacity of many prospective borrowers. However, on the other hand, it is good news for many potential home buyers as it reins in what has recently been rampant property price growth.

The impacts are greatest on:

Property investors: many home loans are assessed at the lender’s floor rate which is already more than 2.5% above the rate offered for the loan, whereas most investment loans are already being assessed at the stressed interest rate.

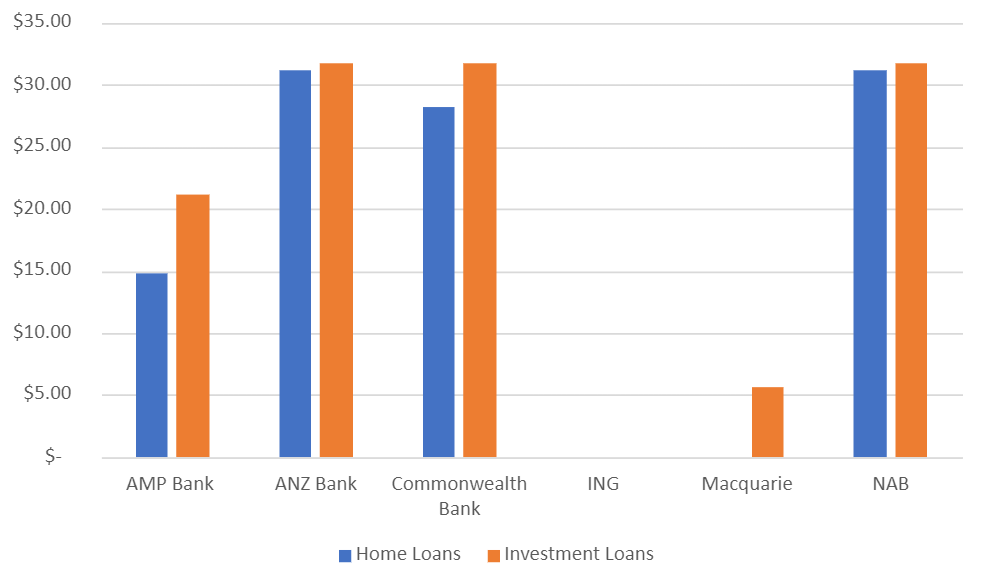

Borrowers with large loan portfolios: For every $100,000 in borrowings over a 30-year term, prospective borrowers will require a minimum additional $32 per month net income to prove servicing capacity.

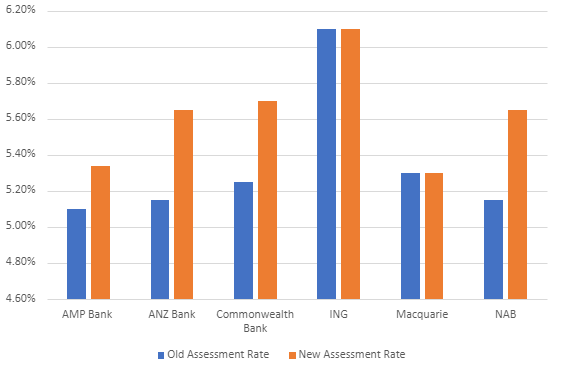

We’ve compiled the following charts, focusing on a range of first and second tier banks, so that you can better understand how this change will affect you.

CHART 1: forecast changes in home loan assessment rates (based on $500,000 loan at 80% LVR)

Chart 1 shows that for some lenders like Macquarie and ING, there has been little or no change, as their lending rates are already more than 3% below their floor assessment rate. But generally, people approaching the major banks will find that their borrowing capacities have been significantly reduced.

Higher assessment rates mean borrowers require more income in order to satisfy lending criteria. Chart 2 shows how this effect plays out. For many banks, borrowers are required to demonstrate an additional $31 net income per month for every $100,000 of total debt that they carry.

chart 2: Additional Income Required Per $100,000 of Total Debt

Does this affect existing borrowers?

The change in assessment rate does not directly affect existing borrowers. However, it may affect their ability to refinance in the future if, for example, their current lender becomes uncompetitive or they wish to borrow more funds. In extreme cases, borrowers can become mortgage prisoners as stricter qualification rules hamper their mortgage mobility.

How does this affect the property market?

Overall, this is an intelligent tweak by APRA. The new restriction disproportionally impacts borrowers using high amounts of debt to fund asset purchases. The lowered capacity to borrow reins in lending, particularly for investment purposes, and thus should over time attenuate the growth in property prices.

Most first home buyers wish that the government and its regulators had taken action 12 months ago.

— Bruce Carr

But has this change come too late? The large escalation in prices over the last 12–18 months has already led to many home buyers to taking on larger mortgages or feeling compelled to relocate far away from friends and family in order to realise their dreams of home ownership. It could be argued that APRA has acted far too slowly to put a brake on debt growth. Most first home buyers wish that the government and its regulators had taken action 12 months ago.

Social sharing

Disclaimer: This article is intended to provide general news and information only. While every care has been taken to ensure the accuracy of the information it contains, neither Loanscape nor its employees can be held liable for any inaccuracies, errors or omission. All information is current as at publication release and the publisher takes no responsibility for any factors that may change thereafter. Readers are advised to contact their financial adviser, broker or accountant before making any investment decisions and should not rely on this article as a substitute for professional advice.

Loanscape has today released its Borrowing Capacity Index for Q4/2024. It confirms the forecast trend that borrowing capacities of Australian individuals and families are recovering from their low levels which coincided with the last of the recent increases to borrowing rates initiated by the Reserve Bank of Australia.