House Prices: The Next Five Years

Republished from Matusik Missive

Yeah, yeah interest rates are rising.

When they do, they negatively impact buyer confidence, which in turn usually lowers economic activity such as property sales. If real estate listings remains steady, or worst still, rise, then housing values can fall.

I don’t know about you, but it seems that every time Philip Lowe opens his gob these days another property commentator or economist announces more babble about dwelling price forecasts.

All I know is that – after about 30 years of analysing the housing market – changing interest rates influence the pace of price rises or falls rather than how far they lift or decline.

I do believe that when looking at where housing values may settle, it is best to use household income as the benchmark.

My table this post shows potential sustainable detached house prices for Australia and the eight capital cities.

The results are based on six (6) times median household incomes for each location.

Importantly the 6x variable is not based on all households, but those households with a mortgage as at early 2022.

One could argue that 3 to 4 times household income is a better ‘affordable’ or ‘sustainable’ housing price gauge.

Well, that used to apply yonks ago, back when the world was flat, one used to bribe the local bank manager to get a home loan, interest rates were in double digits and your job was for life plus bound by a straitjacket.

Let’s just say that today’s world is different. Think loan brokers, loose accounting, the bank of mum and dad, low mortgage rates and work gigs rather than being a salaryman etcetera. Sorry ladies!

So based on 6x household income, Australia’s house prices look to be about 11% overcooked.

Some areas are worse than others – think Sydney, Melbourne, Hobart and Canberra.

Whilst others appear to be near ‘fair value’ such as Brisbane and Adelaide.

Darwin and Perth look underdone.

It is not to say that Perth is going to boom or that Sydney house prices will fall in a massive heap.

All I am trying to do is to provide some logic as to where housing values might settle in the medium term.

Postscript

I am often asked what I think housing is worth.

My reply is always given from the bird’s eye perspective and for yonks that reply been somewhere between 5x and 6x times relevant household incomes.

I have used 6x household incomes in this post, as I think things economic downunder aren’t as bearish as many are suggesting. Overreacting yes. Bullish no.

But if you wanted to use 5x household incomes, then, on average, Australia’s house values are about $170,000 or 16% overcooked, suggesting a ‘sustainable’ median house value of around $900,000.

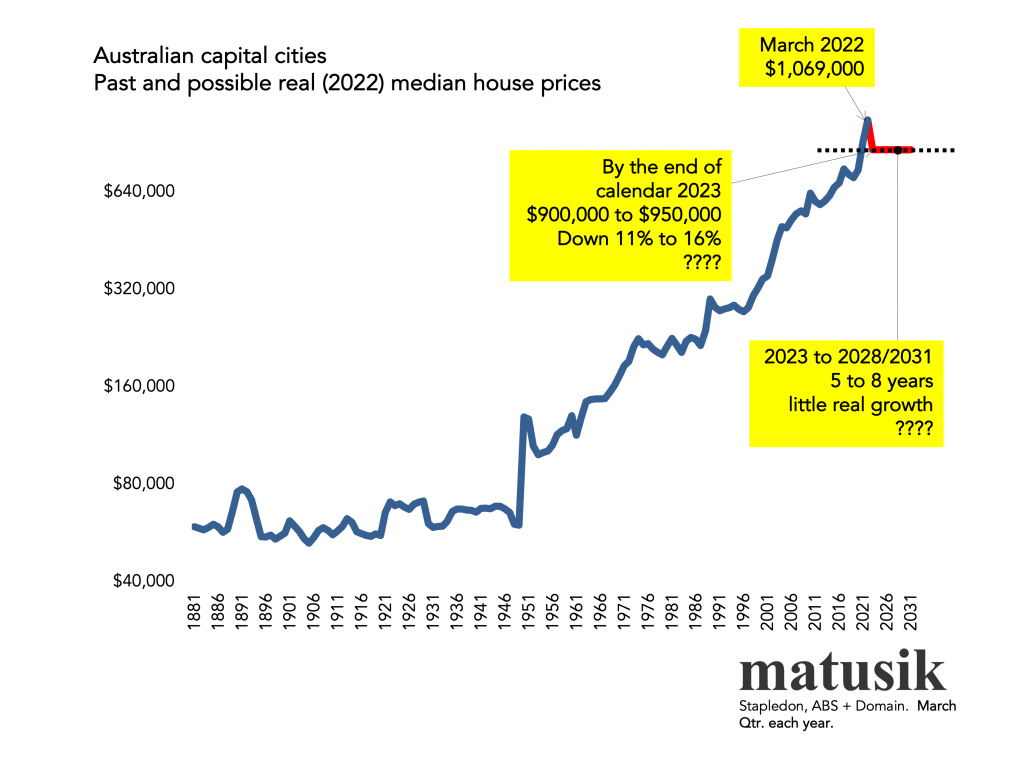

My chart shows what I think will happen over the next five or so years and what such a change looks like over the mid-to-longer term.

Matusik Missive by independent property analyst, Michael Matusik. Every week Michael shares his thoughts on the Australian housing market.

Visit www.matusik.com.au to find out more.

Social sharing

Disclaimer: This article is intended to provide general news and information only. While every care has been taken to ensure the accuracy of the information it contains, neither Loanscape nor its employees can be held liable for any inaccuracies, errors or omission. All information is current as at publication release and the publisher takes no responsibility for any factors that may change thereafter. Readers are advised to contact their financial adviser, broker or accountant before making any investment decisions and should not rely on this article as a substitute for professional advice.

Loanscape has today released its Borrowing Capacity Index for Q4/2024. It confirms the forecast trend that borrowing capacities of Australian individuals and families are recovering from their low levels which coincided with the last of the recent increases to borrowing rates initiated by the Reserve Bank of Australia.